Every Credit Card That Transfers to Air India Maharaja Club (2026)

From Axis Atlas to ICICI Emeralde, here's every Indian credit card that can transfer points to Air India Maharaja Club, with exact ratios and minimum transfers.

If you've ever wondered how to actually get points into your Air India Maharaja Club account without flying, you're not alone. The good news: five Indian banks let you transfer credit card points directly to Maharaja Club. The bad news: the ratios vary wildly depending on which card you have.

The list below is long. Five banks, dozens of cards, different ratios for each. If you'd rather skip the scrolling, the Magnify app shows all of this in one place. Just go to the "Convert From" section, select Air India Maharaja Club, and you'll see every card that transfers with the current ratio. The app stays updated when banks change their rates, and it'll also show you any active transfer bonuses.

But if you want the full breakdown, keep reading.

Axis Bank

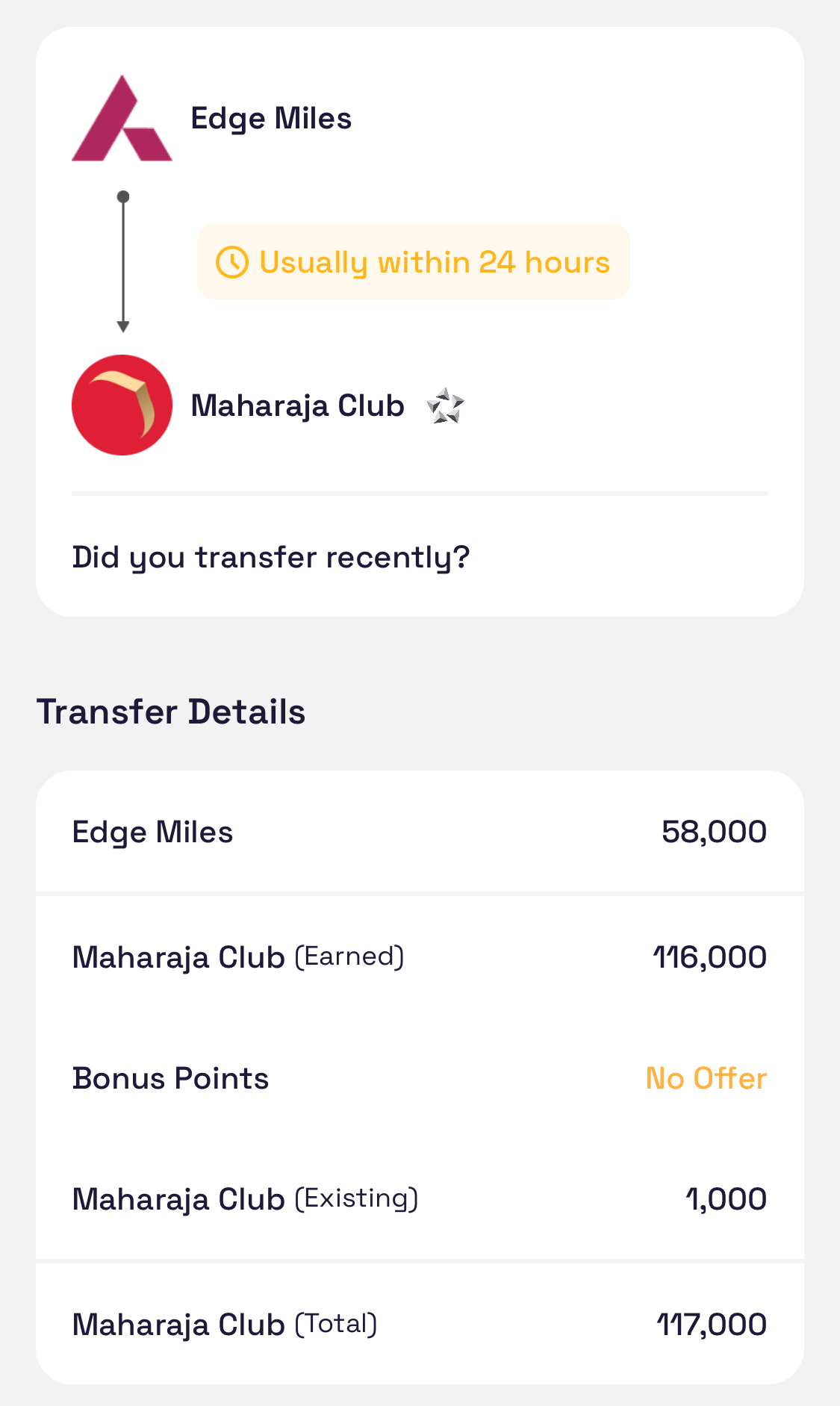

Axis has two separate point currencies that transfer to Air India: Edge Miles (from the Atlas family) and eDGE Rewards (from everything else). The ratios are completely different.

Edge Miles (Atlas, Horizon, Olympus, IndianOil Premium)

| Card | Ratio | You Get | Min Transfer |

|---|---|---|---|

| Olympus | 1:4 | 4 Maharaja Club points per Edge Mile | 500 |

| Atlas | 1:2 | 2 Maharaja Club points per Edge Mile | 500 |

| Horizon | 1:1 | 1 Maharaja Club point per Edge Mile | 500 |

| IndianOil Premium | 2:1 | 0.5 Maharaja Club points per Edge Mile | 500 |

The Olympus is the clear winner here. 1 Edge Mile converts to 4 Maharaja Club points. If you're earning 2 Edge Miles per ₹200 on the Olympus, that's effectively 8 Maharaja Club points per ₹200 spent on eligible categories.

eDGE Rewards (Magnus, Reserve, Privilege, Select, etc.)

| Card | Ratio | You Get | Min Transfer |

|---|---|---|---|

| Magnus Burgundy, Burgundy Private | 5:4 | 0.8 Maharaja Club points per eDGE point | 300 |

| Magnus, Reserve | 5:2 | 0.4 Maharaja Club points per eDGE point | 300 |

| Select, Privilege | 10:1 | 0.1 Maharaja Club points per eDGE point | 300 |

| Rewards, Neo, MY Zone | 20:1 | 0.05 Maharaja Club points per eDGE point | 300 |

The Magnus Burgundy and Burgundy Private cards get the best ratio in the eDGE Rewards family at 5:4. Regular Magnus and Reserve get 5:2, which is still reasonable. The entry-level cards like Neo and MY Zone transfer at 20:1, which honestly isn't worth it unless you have no other use for those points.

Important: Air India falls under Axis Bank's Group B transfer partners, which means more generous annual caps. Even Magnus cardholders get an 8 lakh point limit for Group B transfers.

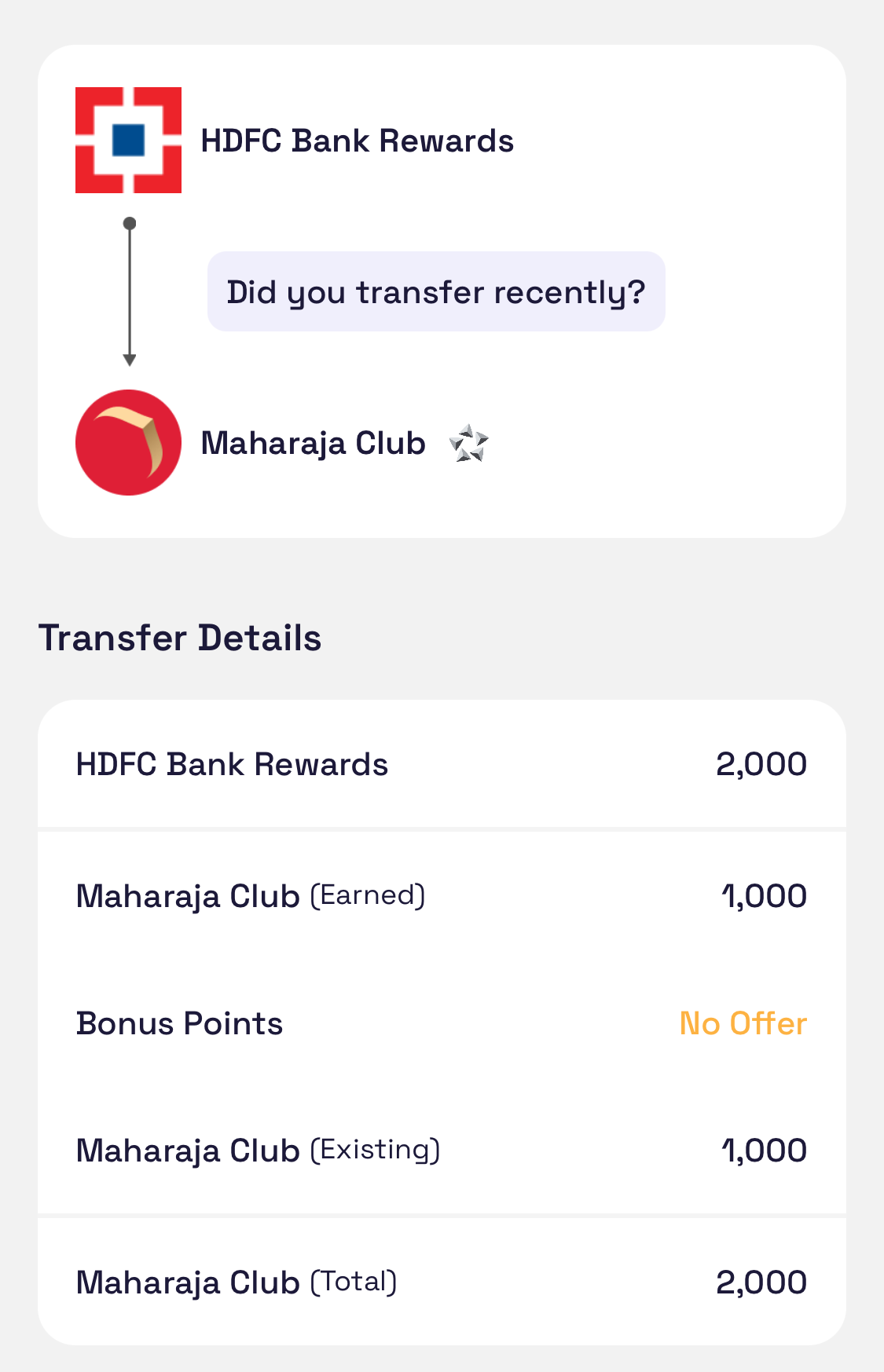

HDFC Bank

HDFC's partnership with Air India is relatively new, and the ratios are solid for their premium cards.

| Card | Ratio | You Get | Min Transfer |

|---|---|---|---|

| Infinia Metal, Diners Club Black | 2:1 | 0.5 Maharaja Club points per reward point | 200 |

| Regalia Gold | 3:1 | 0.33 Maharaja Club points per reward point | 300 |

If you have an Infinia or Diners Black, the 2:1 ratio is decent. Regalia Gold at 3:1 is passable but not exciting.

SBI Card

SBI has the co-branded Air India cards which transfer at 1:1, plus their Miles card family.

| Card | Ratio | You Get | Min Transfer |

|---|---|---|---|

| Air India Signature | 1:1 | 1 Maharaja Club point per SBI point | 10,000 |

| Air India Platinum | 1:1 | 1 Maharaja Club point per SBI point | 5,000 |

| Miles, Miles Prime, Miles Elite | 1:1 | 1 Maharaja Club point per SBI point | 1,000 |

| Aurum | 5:1 | 0.2 Maharaja Club points per Aurum point | 500 |

The co-branded Air India SBI cards and the Miles family all transfer at 1:1, which is straightforward. The high minimum on the Signature card (10,000 points) might be annoying if you don't accumulate quickly.

The SBI Aurum transfers at 5:1 to Air India, which isn't great value.

HSBC

HSBC has some surprisingly good options, especially the Premier card.

| Card | Ratio | You Get | Min Transfer |

|---|---|---|---|

| Premier | 1:1 | 1 Maharaja Club point per HSBC point | 1 |

| TravelOne | 1:1 | 1 Maharaja Club point per HSBC point | 1 |

| Visa Platinum | 2:1 | 0.5 Maharaja Club points per HSBC point | 2 |

| Classic, Gold, MakeMyTrip cards | 2:1 | 0.5 Maharaja Club points per HSBC point | 100 |

The HSBC Premier and TravelOne cards both get 1:1 transfer ratios with a minimum transfer of just 1 point. That's genuinely useful if you want to move points over regularly.

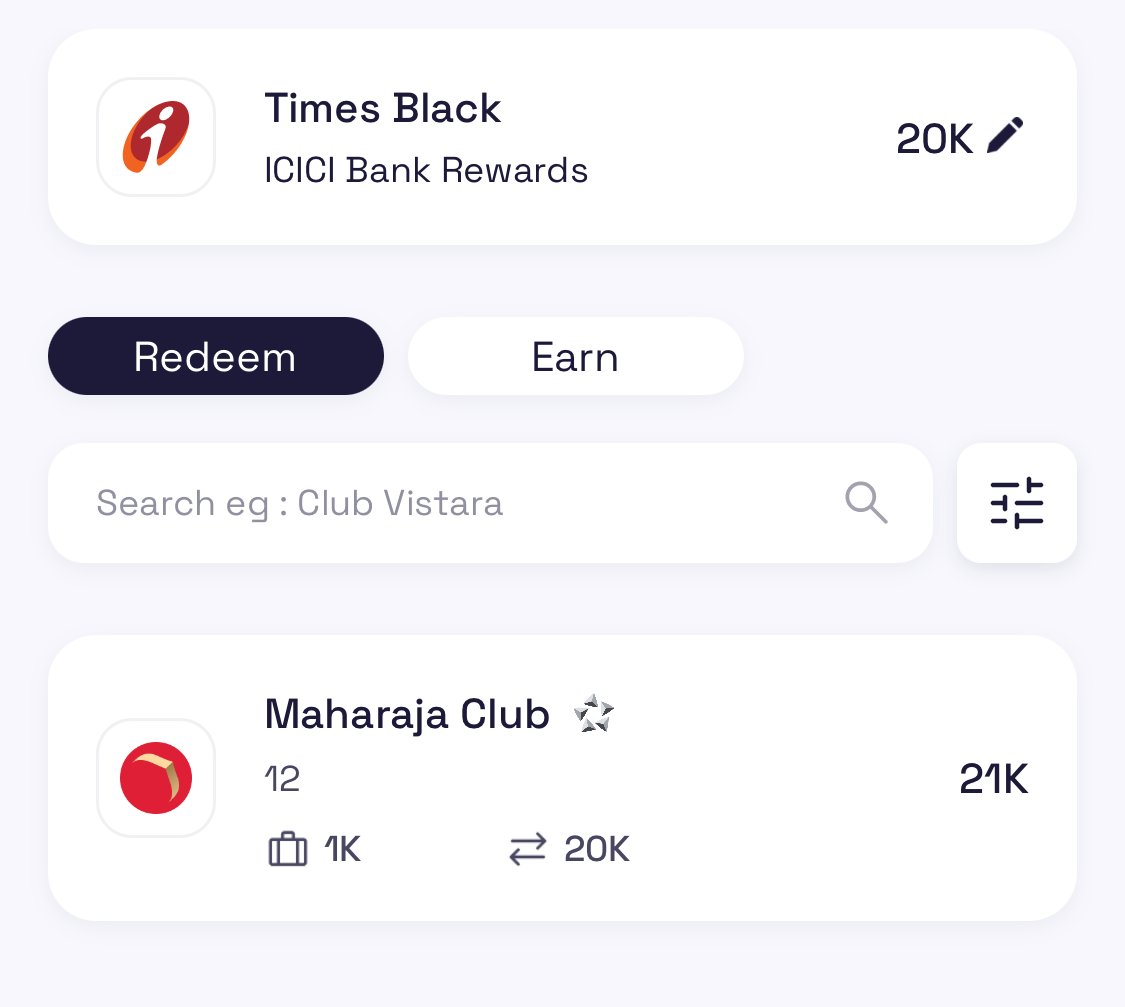

ICICI Bank

ICICI only offers transfers from their ultra-premium cards.

| Card | Ratio | You Get | Min Transfer |

|---|---|---|---|

| Emeralde Private Metal | 1:1 | 1 Maharaja Club point per ICICI point | 1 |

| Times Black | 1:1 | 1 Maharaja Club point per ICICI point | 1 |

Both cards transfer at 1:1 with no meaningful minimum. If you have access to either of these cards, the transfer is straightforward.

The Best Value Cards for Air India

If Air India is your primary goal, here's how I'd rank the options:

- Axis Olympus (1:4) – Best ratio currently available

- Axis Atlas (1:2) – Solid ratio, popular card

- HSBC Premier/TravelOne (1:1) – Simple math, low minimums

- ICICI Emeralde/Times Black (1:1) – If you have access

- SBI Miles cards (1:1) – Good if you're already in the SBI ecosystem

- HDFC Infinia/Diners Black (2:1) – Decent, but Infinia has better transfer partners

- Axis Magnus Burgundy (5:4) – Reasonable for eDGE points

A Few Things to Remember

Transfer times: Most transfers take 2 to 10 days. HDFC tends to be on the faster side (4 days), Axis can take up to 10 days.

Minimum transfers: Watch the minimums. SBI Air India Signature requires 10,000 points minimum, while HSBC Premier needs just 1 point.

Points expiry: Once your points land in Maharaja Club, the 24-month inactivity clock resets. Transfers count as earning activity.

Don't transfer speculatively: Unless you have a specific redemption planned, keeping points with your bank gives you more flexibility.